Business Challenge

Our Tier 1 financial services client was unable to consistently meet the cutoff times for their payment and settlement processing due to their unstable production systems which could not cope with the high volumes.

They were facing frequent incidents and were unable to track their trades without a reporting tool, and couldn’t implement improvements as they were hampered by legacy infrastructure and applications, and outdated inflexible architecture.

The Solution

The bank needed a new stable, agile, integration and payments orchestration solution to manage the high volumes, reporting requirements and be fit for future demands.

The Sandhata team ran a pilot introducing TIBCO ActiveMatrix BusinessWorks and delivered:

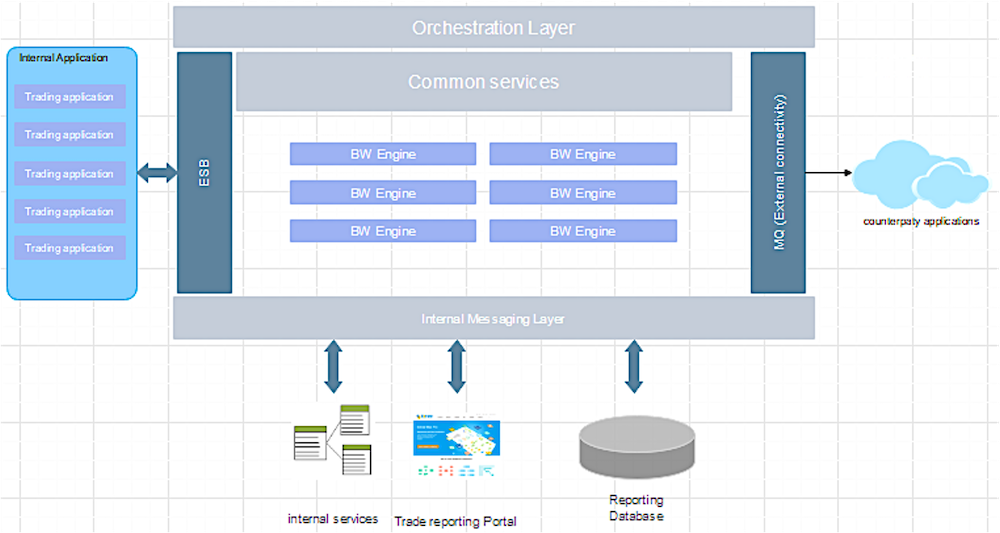

- Newly designed flexible architecture based on SOA principles and common reusable frameworks

- Robust integration layer with TIBCO BW

- Full end-to-end test automation framework with IBM RIT

- Bespoke real-time reporting dashboard with TIBCO Spotfire

The new solution addressed the business problems with minimal cost and within 2 years with the new system we have:

- Built 200+ processes

- On boarded 30+ trading applications

- Integrated 10+ counterparty systems

KPIs

- 75% increased number of releases per month

- 50% increased testing efficiency

- 60% reduction in defects related to environmental dependencies

- 90% reduction in incidents (no P1 incident in first 2 years)

Key Facts

- Processing 2 million messages per day

- Processing £1 trillion worth of payments and settlement messages per week

Benefits

Faster Onboarding

- The legacy application required redevelopment for any new client

-

The new system allows onboarding new clients with config change

Modern Service Management and Reuse

- We first created the services and interface layer, forming a common framework to be reused for all future projects and operations.

- We focused on service reuse, enabling quick development and release cycles and accelerating testing and release cycles with full automation.

The Team

This project was achieved through the close collaboration of Sandhata’s team of integration and testing experts and the bank’s project team. Our domain expertise in finance helped us to identify potential issues before they escalated and deliver the solution to address requirements even before they arose.

Bronwyn Davies

Latest posts by Bronwyn Davies (see all)

- Winner! Unicom Most Innovative Project 2023 - 27th February 2023

- Sandhata Gini – Our internal chatbot - 1st February 2023

- Goodbye 2022 - 19th December 2022